Key results in 2021

In 2021, the global art market regained much of its customary dynamism, and a whole lot more as well. Among other factors, the recovery was driven by the return of major masterpieces to auction rooms and a sustained pace of transactions at all price levels.

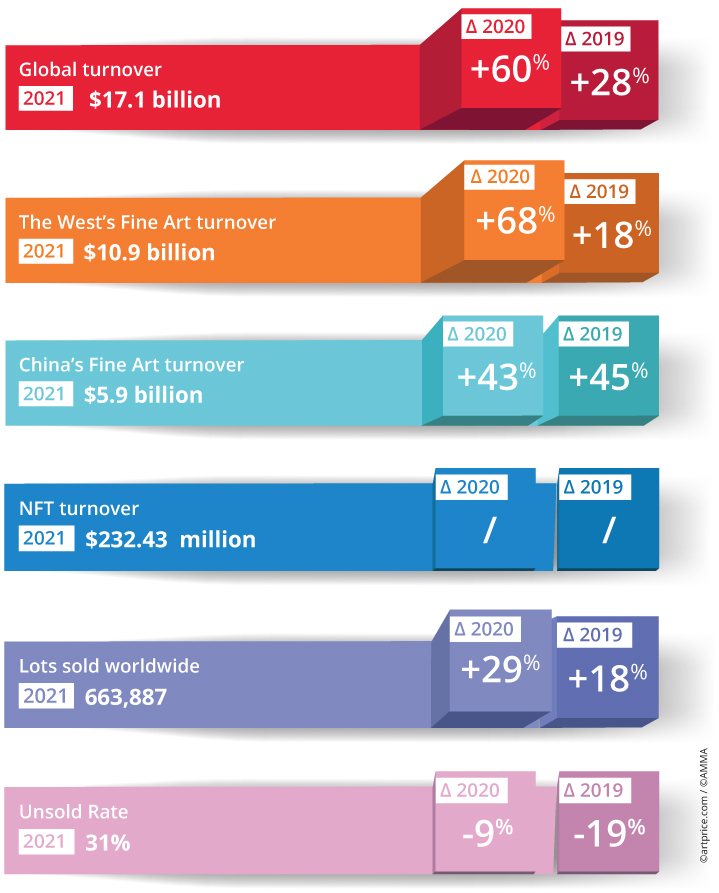

After the growth seen in 2021, all the indicators are in the green again and the recovery appears to have precipitated a new dynamic that has structurally reconfigured the global market. Indeed, the year 2021 stands out as one of the best in history. No less than $17 billion worth of artworks were exchanged around the world, representing a growth of +60% compared to the previous year when, it should still be remembered, art sales suffered the full impact of the first waves of the Covid pandemic and a series of lockdowns. The auction segment suffered quite badly with an overall 10% contraction in sales sessions in 2020, almost as much in terms of lots sold, and global sales turnover down 21%.

But… the crisis ultimately had positive repercussions on the structure of auction houses and on the quality of exchanges, considerably accelerating the art market’s digital transformation. The key indicators for the global art market as a whole (turnover, transaction volumes, sold rates, price indices) all show that a new momentum has gripped the sector.

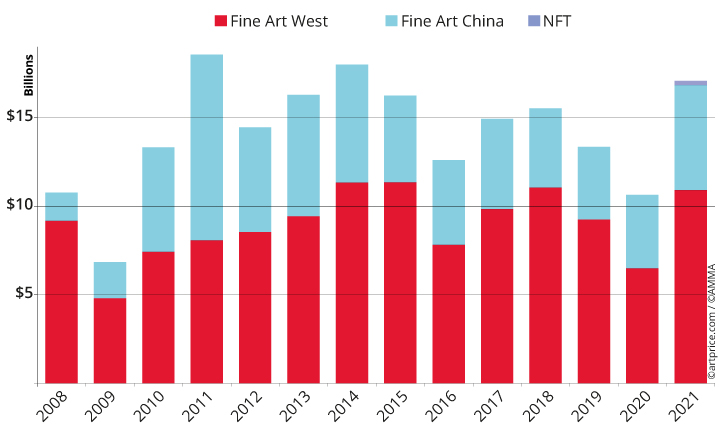

Evolution of the Art Market

The health of the art market is reflected both in the vigorous price levels and in the number of works sold last year, which reached a record. The enthusiasm of bidders is evident in the 664,000 lots exchanged, almost a third more than the previous year and a 161% increase versus 20 years earlier. The digital transformation of auctions – accelerated by the health crisis – has been a key driver in the expansion of transaction volumes. Totally ‘globalized’ by virtue of going online, auctions are constantly winning new clients and followers.

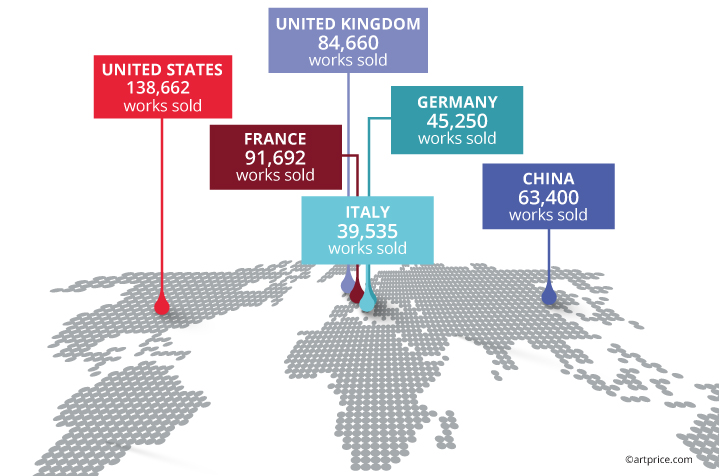

Transactions: the most dynamic countries (2021)

Another revealing indicator, the unsold rate, is at its lowest level for several years: 31%, versus an average fluctuating between 34% and 39% in previous years. This indicates a clear balance between supply and demand and the establishment of a formidable sales dynamic, which benefits all market segments, from the most affordable works to the most prestigious. The volume of transactions for works under $10,000 jumped by a quarter, while the number of works that fetched over a million US dollars (1,734) posted a growth of +44% compared to 2020.

China / West

The Chinese art market never ceases to amaze. Already in 2020, it swam against the tide of the Western market, growing slightly (+2%) despite a sharp drop in the number of transactions during the health crisis (-40%). The activity of wealthy Chinese buyers, little (or not at all) impacted by the pandemic, drove significant sales of historical and modern works during the second half of 2020. The country’s market progressed even more briskly last year, with a 43% increase in turnover, reaching $5.9 billion. This total put China ahead of the United States ($5.7 billion), despite a much lower number of transactions.

The American market is structured differently from the Chinese market, via a much denser and more diversified offer. The number of transactions there is twice as high as in China, with a historic record exceeding 138,000 lots sold in the United States last year. In sharp increase (+38% since 2019), American transactions now represent more than 20% of global art auction transactions.

The Western art market returned to its highest level, with total turnover of $10.9 billion. The West owes its superb performance to the return of high-profile masterpieces – from Sandro Botticelli to Jackson Pollock, from Gustave Caillebotte to Frida Kahlo – after a natural contraction in the ultra-high-end market during the 2020 pandemic when revenue dropped -30% despite a stable number of transactions.

Evolution of global auction turnover

AMMA (Art Market Monitor of Artron): In 2021, 109,800 works were put up for sale on the art auction market in China. 63,400 of these works sold for a total of $5.935 billion, leaving 42% of the items unsold. Compared with 2020, the market demonstrated strong recovery. Number of lots at auction, sales volume, and turnover increased by 37%, 58%, and 43% respectively.

In terms of different categories, contemporary art performed remarkably well, maintaining its growth trend of recent years. Chinese calligraphy and painting had 95,900 works at auction, with 54,000 works sold for a total of $3.907 billion. The three indicators increased by 31%, 54%, and 41%, respectively. Contemporary art had 14,000 works at auction, with 9,335 sold for a total of $2.029 billion. The three indicators increased by 90%, 92%, and 45%, respectively.

The improved performance of higher price range works was further proof of market recovery, with 133 works traded at prices in excess of $5 million, representing a YoY increase of 31 works and a total sales value of $1.674 billion. This is an increase of $384 million compared to 2020.

The excellent response to Covid-19 in China meant that the art market was able to organize various events to help boost recovery. Moreover, the auction market achieved its goal of reducing quantity while improving the quality of auctions. Many auction houses upgraded their brands and diversified their business by introducing online auction options, financial services, art exhibitions, etc. Subsequently, the overall art market remains active. Along with auctions, art fairs and exhibitions are also booming.

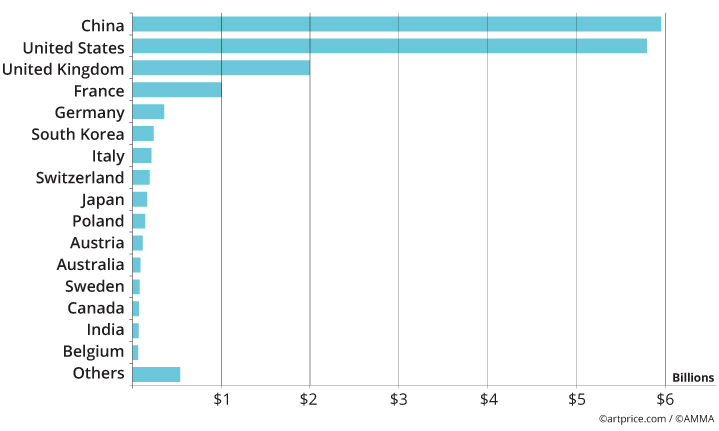

Geographical breakdown of auction turnover by country

→ Leader in 2020 with performances maintained despite the pandemic, China maintained its lead over the United States in 2021. The two countries generated respectively $5.9 billion and $5.7 billion in art auction turnover. The United Kingdom is struggling to reconnect with its previous $2 billion total, while France crossed the one billion dollars threshold for the first time.

Decline in the United Kingdom

In an ultra-competitive and constantly changing market, the United Kingdom maintained its third place with an art auction turnover total of $1.9 billion, a result down $210 million versus 2019 (ie before the pandemic) despite a growth in the volume of transactions (+15% of lots sold). The UK’s performances are thus tending to contract in the shadow of the predominance of the American market, but also as a result of competition from Hong Kong, China (to which we will return), and the French market that has just posted strong growth with a turnover total exceeding one billion dollars for the first time ever.

First billion-plus turnover total in France

Ranked fourth in the world, the French art market posted a solid performance, for the first time exceeding one billion dollars. Its growth, constant between 2015 and 2019, then slowed by the pandemic in 2020, resumed with renewed vigor to set a historic record while the UK market decelerated. With more than 91,000 lots sold, France was the densest and most diversified marketplace in the world after the United States, selling twice as many works of art as its immediate neighbor, Germany.

The French market is driven by a multitude of auction houses on its territory and by the strong activities of Christie’s and Sotheby’s in Paris. Essentially, the two auction houses accounted for $539 million of the art auction turnover hammered in France last year, i.e. more than half the total, thanks mainly to a number of excellent results. These results came from two masterpieces by René MAGRITTE (La Vengeance, $17.2 million at Christie’s and The Art of Conversation, $14.4 million at Sotheby’s), an important painting by Vincent VAN GOGH (Street Scene in Montmartre, $15.4 million at Sotheby’s and Mirabaud-Mercier) and a triumphant sale of work by François-Xavier LALANNE which alone took $89 million (Sotheby’s).

Vincent VAN GOGH (1853-1890)

South Korea joins the Top 10

South Korea led by Seoul, and Japan led by Tokyo both achieved record performances. Both countries ranked in the Top 10 global marketplaces with a clear lead for South Korea. Despite a small number of lots sold (less than 2,700), the Korean market has leapt forward in the last two years: it now weighs $237 million, versus a pre-pandemic total of $58 million, i.e. a turnover total multiplied by four. South Korea is asserting itself as a major new power on the global art market. Endowed with a prestigious artistic scene and artists with explosive prices – Ufan LEE, Seo-Bo PARK, Whan-Ki KIM – the country has succeeded in supplanting historical market places like Italy and Japan.

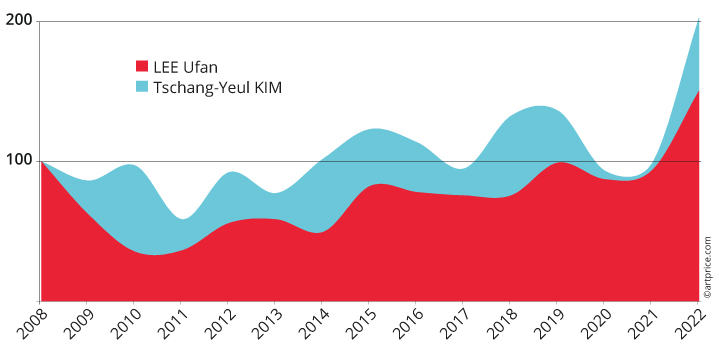

Comparative price indices of Lee Ufan and Tschang-Yeul KIM

→ $100 invested in 2001 in a work by Kim Tschang-Yeul is worth an average of $1,588 today (+1.488%). Lee Ufan’s price index has risen by +807% in 20 years.

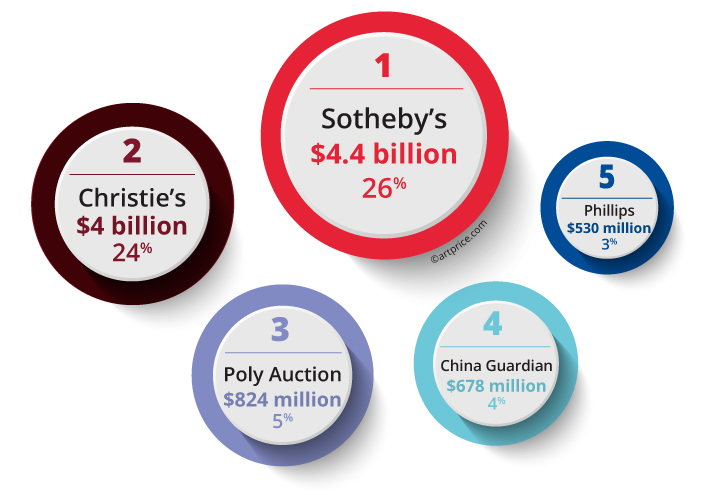

Top 5 auction houses

The major international auction houses have demonstrated a strong capacity for innovation in response to the constraints resulting from the Covid pandemic. Their great agility not only made it possible to retain the confidence of sellers and buyers, but also to come out of the crisis even stronger by considerably expanding their audiences.

The 2021 performances of Christie’s and Sotheby’s more than offset the sharp contractions suffered in 2020 (when Sotheby’s turnover dropped 29% with a $1 billion shortfall in turnover vs. 2019, and Christie’s dropped 41% with a shortfall of $1.5 billion). In 2021, the figures were clearly on the rise again and the two companies together generated $8.4 billion from artworks sold at auction, i.e. half of the total art auction turnover hammered worldwide.

Top 5 auction houses

The third Western sales company, Phillips has had its best year since its founding in 1796, private and public sales combined. Public sales alone generated $530 million, and if we add the results of its sales organized jointly with the Chinese company Poly International, the total was $706 million. Its annual sold rate was an impressive 88% and it even achieved two white-glove sales: one in June, selling 100% of the works presented in Hong Kong during a sale co-organized with Poly International, then another in New York a few days later. Phillips’ attractivity continued to grow with the creation of 44,000 new accounts and a 26% increase in new customers on its online platform during the year 2021.

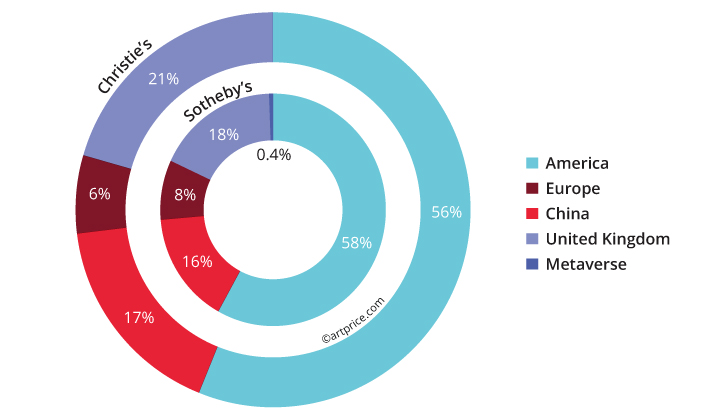

The United States still accounts for more than half of the annual result of the major Western auction houses: Christie’s generated 56% of its art auction turnover in New York, Sotheby’s 58%, while Phillips generated 54% of its business in New York ($380 million).

In addition, the activities of Christie’s, Sotheby’s, and Phillips are developing at high speed in Asia. China now accounts for 17% of Christie’s global sales revenue, a much higher share than its European performance (6%).

Geographical breakdown of art auction turnover from Sotheby’s and Christie’s (2021)

40.3

40.3